Product Design Lead | 6 Months

Digital Transformation: Cashless Gaming

Gaming regulations have dramatically changed to address money laundering and responsible gaming issues in recent years. These changes required gaming establishments to implement measures to maintain their licences and continue operations. The main challenge was to meet these new regulatory requirements while minimising the impact on customers and operations and maintaining current gaming KPIs. The project meant gaming establishments needed to transition from fiat currency to cashless systems, a significant shift for casino table games, which have always relied on cash transactions. As the Product Design Lead, I guided the project through this digital transformation’s discovery, ideation, design, prototyping, and testing phases.

— The Process

Discovery

Stakeholder Interviews

SWOT Analysis

User Workshops

Data Analysis

Landscape Analysis

Diary Studies

Affinity Mapping

Ideate

Brain Writing

Mind Mapping

Crazy Eights

Storyboarding

User Flow Mapping

Impact Mapping Workshops

Design

Process Flows

Wireframing

Prototypes

Proof Of Concepts

Validate

Quantitative Data Analysis

Qualitative Data Analysis

Product Retrospectives

— KICK-OFF

In the project’s initial phase, it was crucial to recognise and manage the multiple streams of work required to address the array of regulations and the omnichannel they affect. We began with comprehensive kickoff sessions to identify distinct problem statements, which we then segmented into different streams of work: registration, identity, user behaviour tracking, and gaming experience. This segmentation allowed us to break the broader challenges into more manageable projects.

Focusing on the table gaming experience project, I collaborated with the team to arrange requirements-gathering workshops with stakeholders. Due to multiple stakeholders and department biases, these workshops were crucial for defining roles and responsibilities and aligning the product vision and a North Star metric. This methodical approach ensured that all team members and stakeholders agreed and continued to steer the product in the right direction, enabling a more organised and efficient design process.

— DISCOVERY AND SYNTHESIS PHASE

I collaborated with individual teams to document existing KPIs, followed by retrospective and journey workshops to document and assess existing processes. With the help of a solution architect, we mapped out the existing digital platforms and touchpoints, identifying those that needed to be maintained internally and for customer interactions.

I then conducted in-depth research, including user workshops, diary studies, and data analysis of existing players and responsible gaming behaviour. Additionally, I performed a landscape analysis against indirect competitors to review how industries like Disney use applications and wallets to manage customer spending across resorts.

Leveraging quantitative and qualitative data, I facilitated team workshops for affinity mapping, empathy mapping, and journey mapping. These methods helped the team identify trends, pain points, and opportunities. I used this synthesised data to create situational personas and user journeys.

Following this, I worked with stakeholders to perform SWOT analysis and dot voting tasks to prioritise key focus areas. This thorough discovery and synthesis phase ensured our ideas were well-informed and targeted towards the most critical areas.

— Ideation

Internally, we ran brainstorming workshops, including brain writing, mind mapping, crazy eights, storyboarding, and user flow mapping. These sessions were crucial for generating a wide range of innovative ideas and ensuring that all potential solutions were explored.

I also performed impact mapping workshops with individual stakeholders and their teams to capture their thoughts and ideas. This approach allowed us to assess the potential impact of various solutions from multiple perspectives, ensuring a comprehensive evaluation process.

These sessions explored multiple ideas, including resort wallets on mobile devices, implementing facial recognition at tables, utilising NFC and QR codes for table activities, developing dealer systems, incorporating NFC chips, establishing buy-in spots, and designing electronic chip dispensers. These concepts addressed the critical challenges identified during the discovery phase, such as player identification, behaviour monitoring, and spending tracking.

— DESIGN & PROTOTYPING

I began rapid prototyping many defined ideas, critiquing them from user and implementation perspectives. I collaborated closely with tech teams and solution architects to pressure-test the ideas for implementation and feasibility. This iterative process continued until we developed four primary solutions incorporating multiple ideas and touch-points.

I continually showcased these prototypes to stakeholder teams and users, gathering feedback and fine-tuning the designs through iterative critique and testing sessions on testing tables. This thorough ideation process ensured that our solutions were innovative, feasible, and aligned with both user needs and regulatory requirements.

— POC Testing

After multiple mid-fidelity prototyping, testing, and ideation cycles across teams, users, and stakeholders, I worked with a developer to build functional POCs to replicate real-world solutions. The POCs included all core functionalities of the prototypes while tracking key metrics to quantify performance post-tests.

I oversaw and ran testing sessions in a controlled environment across multiple sessions. The tests simulated real-world environments with six tables for 3 hours per session, including dealer changeovers and players joining at different times to mimic low and high periods. I recorded results via session video recordings, post-experience interviews and POC tracking data.

The existing solution was used as a control against which all test metrics were compared. The key metrics tracked were hand rate, user satisfaction, player gaming time accuracy, and feedback. Thorough and improved testing allowed us to validate, optimise, and finally focus on a single multifaceted solution ready for real-world application.

— Project Challengers

In a project of this scale, numerous challenges surfaced daily. The key issues the team and I faced included:

- Managing Multiple Stakeholders with Differing Priorities: With various departments involved, aligning stakeholder interests was crucial yet challenging. To address this, I initiated product vision workshops with all stakeholders early in the project. These workshops ensured everyone agreed on the project’s key directions and goals. Working with the Head of Product, we defined a process where any stakeholder proposing additional initiatives or changes to the scope would need to present them during regular meetings. This ensured that any updates aligned with the initial vision. While these sessions allowed for challenging and refining the vision, the primary goal was to maintain alignment and transparency so all stakeholders and team members understood the potential impact of any changes.

- Evolving Legislation and Regulatory Requirements: Another significant challenge was the constantly changing regulatory landscape, which created moving targets for the project. To tackle this, I collaborated closely with the Head of Product to continuously define and update the known, unknown, and potential risks. I structured the design process to prioritise quick ideation and design iterations that met the locked-in regulatory requirements while remaining flexible for future changes. This approach allowed us to address immediate needs efficiently and kept us agile, enabling quick pivots to accommodate emerging requirements. By focusing on rapid prototyping, we could test concepts early, with low overheads and identify potential solutions for the unknowns without prematurely overcommitting resources to high-fidelity designs.

- Handling Existing Technology Overhead: The digital transformation required maintaining a significant amount of existing technology infrastructure. Working closely with an enterprise solution architect, we developed detailed technical architecture diagrams, process flows, and user journey maps. These tools were instrumental in ensuring that the user experience aligned with the technical feasibility over time. They also helped us estimate the effort needed for system upgrades and prioritise them based on their value to the overall experience. As we rolled out different phases of the solution, we continually tested and adjusted our plans to ensure the evolving experience met expectations.

- Dealing with a Diverse Customer Base: Adapting to the varied technical proficiency among customers was another critical challenge. To address this, I designed fallback solutions that catered to those less likely to engage with touchscreens and self-serve processes. This included incorporating physical cards and table payment terminals as alternatives to mobile apps and digital solutions. Additionally, we deployed extra customer support team members to guide less tech-savvy individuals through any learning curve challenges. These considerations ensured that while the business and most users could benefit from more efficient processes, no segment was left behind in the digital transformation.

— Outcome

The final solution included a comprehensive suite of touchpoints designed to enhance the gaming experience while meeting stringent regulatory requirements. Key components of the solution were:

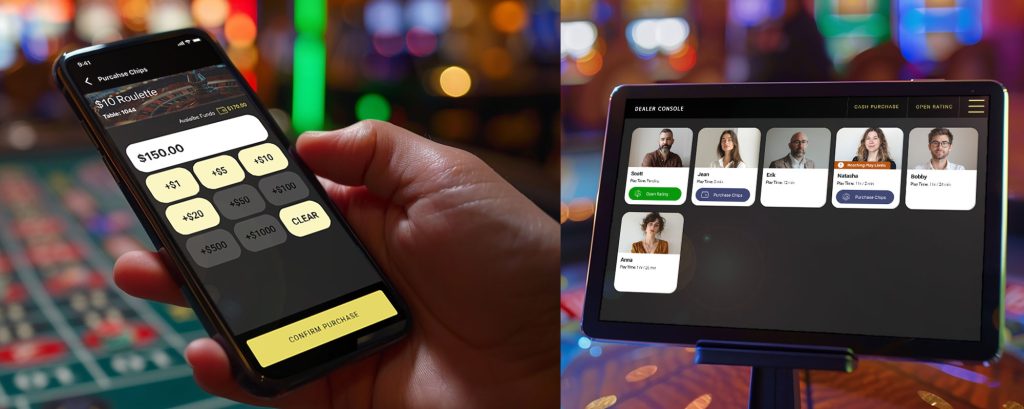

- Mobile Wallet App: This app allows players to manage digital funds, account settings, play limits, and chip purchases at tables seamlessly. It provided a convenient and secure method for managing their gaming activities.

- Physical Cards and Table Payment Terminals: These terminals served as a fallback solution and for customers who preferred not to use the app. They enabled players to perform cashless transactions directly at the tables, ensuring every customer was included in the digital transformation.

- Table NFC Tags: These tags enable patrons to join tables effortlessly by tapping their mobile device or card, streamlining the process of entering and exiting games.

- Dealer Console: A simple touch-screen system for dealers to manage customer interactions and process cashless transactions efficiently. This console improved the overall customer management experience for dealers.

- Customer Support Staff: Dedicated staff were assigned to oversee six tables, supporting customers in learning the new system. This ensured that the transition to the new system did not impede the dealer’s efficiency and gameplay.

This robust system allowed for more accurate behaviour tracking, significantly mitigating money laundering issues and improving responsible gaming tracking accuracy by 17%. The self-serve and streamlined process reduced the multiple tasks imposed on dealers, resulting in a 2% increase in hand rate, thereby speeding up gameplay compared to existing times.

General feedback from users indicated that the mobile experience did not adversely affect their gameplay. Many appreciated not needing to carry cash, and the digital experience was reported to streamline overall interaction with the gaming environment. A small group of users required guidance on the new system, but the presence of customer support staff effectively mitigated any potential negative impact.

Improved notifications and customer engagement regarding their gaming behaviour led to better transparency and improved sentiment towards responsible gaming operations. The solution’s ability to provide players with insights into their behaviour and enforce play limits was well-received, highlighting the project’s success in balancing regulatory compliance with an enhanced user experience.